The Charities (Protection and Social Investment) Act 2016: an analysis of compliance with fundraising reporting as of July 2022

Jump to heading

Introduction

The Charities (Protection and Social Investment) Act 2016 (the Act) requires charities in England and Wales with an income of over £1 million to provide statements on specific areas of their fundraising in their annual report, which is submitted to the Charity Commission for England and Wales.

These statements cover key aspects of a charity’s fundraising activity, including:

- the approach taken to fundraising

- whether the charity is subject to any regulation

- how it monitors fundraisers

- the number of fundraising complaints received; and

- steps taken to make sure vulnerable people are protected.

Fundraising reporting requirements of the Charities Act 2016

The Charities (Protection and Social Investment) Act 2016 section 13 adds a new section 162A to the Charities Act 2011 which states:

If section 144 (2) applies to a financial year of a charity, the annual report in respect of that year must include a statement of each of the following for that year -

- the approach taken by the charity to activities by the charity or by any person on behalf of the charity for the purpose of fund-raising, and in particular whether a professional fund-raiser or commercial participator carried on any of those activities

- whether the charity or any person acting on behalf of the charity was subject to an undertaking to be bound by any voluntary scheme for regulating fund-raising, or any voluntary standard of fund-raising, in respect of activities on behalf of the charity, and, if so, what scheme or standard

- any failure to comply with a scheme or standard mentioned under paragraph (b)

- whether the charity monitored activities carried on by any person on behalf of the charity for the purpose of fund-raising, and, if so, how it did so

- the number of complaints received by the charity or a person acting on its behalf about activities by the charity or by a person on behalf of the charity for the purpose of fund-raising

- what the charity has done to protect vulnerable people and other members of the public from behaviour within subsection (2) in the course of, or in connection with, such activities.

Including these statements in the annual report means that charities can demonstrate that they are reporting in line with legal requirements. It also encourages openness and transparency and helps to build public trust in their processes.

In July 2022, we reviewed the reports of 198 charities with an income of over £1 million. Of these charities:

- 157 had paid the voluntary Fundraising Levy for 2021/22 as they had spent over £100,000 or more each year on their fundraising activities – we refer to these throughout as ‘levy-payers’.

- The remaining 41 either actively refused to pay the levy or did not respond to invoices to pay and follow-up reminders (levy-refusers).

For more information, see the methodology.

The aim of this review is to provide a benchmark for the charity sector, highlight good practice, and identify areas for improvement in the reporting of fundraising activity. In this report we have not named organisations and all data is anonymous.

Overall key findings

This is the fourth year that charities have had to meet the Charities Act 2016 reporting requirements, and this is the third year we have conducted an analysis of reports during this period.

There are general signs of improvement

Whilst comparison between the three pieces of research is limited due to a differing scoring system, there are signs of improvement in reporting. An increasing number of levy-paying charities reported on fundraising approaches (88%), voluntary regulations and schemes (80%), and complaints (69%) compared to previous years.

More information is needed about monitoring and protecting the vulnerable

However, compliance is still not good enough. Only 40% of levy-paying organisations provided information about how they monitor fundraising activities carried out ‘on behalf of’ the charity, and only 48% stated what they do to protect vulnerable people and other members of the public while fundraising.

These policies are important because they keep people safe and show that organisations are committed to protecting donors and potential donors alike. By not including this information in their reports, these charities are not demonstrating that they have such policies in place. This may diminish trust in their fundraising processes and negatively impact the reputation of the charity.

Even when these fundraising statements were included, they typically lacked sufficient detail. Although this is not a requirement of the Act, we believe it is vital that charities communicate their fundraising activities in an accessible and meaningful way to the public in order to be accountable. Providing this information in a clear and detailed manner is important for promoting openness and demonstrating a transparent commitment to good standards of fundraising.

Charities which did not pay the levy were less likely to meet the requirements

This year’s analysis also included levy-refusing charities, and we found that these charities were less likely to report on each of the requirements in comparison to levy-paying charities. They were also less likely to provide enough clarity and detail when reporting.

Although there are only 41 levy-refusing charities with an income of over £1 million – a relatively small sample size – this research suggests that these charities must also greatly improve their reporting to comply with the Act. In particular, these levy-refusing charities should explain why they do not adhere to the conditions of voluntary regulation by the Fundraising Regulator, as per Act requirement (c).

Compliance of levy-paying charities

Summary

We reviewed the reports of 157 levy-paying charities. Excluding those which did not use third party fundraising, overall:

- only 33% of charities (47 of 144 reports) included a statement on each of the requirements a, b, d, e and f; and

- 9% (13 of 144) reported on none of the requirements.

Almost nine in 10 charities included a statement setting out their fundraising approach and outlined whether they were subject to voluntary regulation, such as being registered with the Fundraising Regulator (eight in 10). Approximately seven in 10 included a statement about the numbers of complaints received in the past 12 months.

More concerning is that just four in 10 charities reported on how fundraising carried out on their behalf is monitored, and fewer than five in 10 included a statement on how they protect the public and vulnerable donors.

Levy-paying charities reported on each of the six requirements a to f in the Act as follows:

- 86% included a statement about their fundraising approach (135 reports).

- 80% included a statement on the regulation or schemes they adhered to (126 reports).

- 0% mentioned a failure to comply with a regulation or scheme (0 reports).

- 40% included a statement on monitoring fundraising activities carried out ‘by another person on behalf of the charity (58 of 144 reports; 157 reports were reviewed but 13 charities stated that all fundraising was carried out internally).

- 69% included a statement on the number of complaints about fundraising received in the last 12 months (109 reports).

- 48% included a statement on what the charity has done to protect vulnerable people and other members of the public whilst fundraising (76 reports).

Overall, when these charities provided statements reporting on the required sections of the Act, they presented this information in a clear way for the reader.

- Across all the statements, we gave between 72% and 98% of charities a positive score for the clarity of their reporting.

- Our analysis also found that 82% of reports had all the statements in the same section, allowing the reader to find all the information linked to the requirements with greater ease.

However, most statements did not provide detailed information on charities’ fundraising activities. Across all the statements, we only gave positive scores to between 29% and 69% of charities for the detail of their reporting. Of those reports which included a statement, for each requirement:

- 45% gave a detailed account of their fundraising approach, including the methods of fundraising they used and who carried out that fundraising.

- 69% gave a detailed account of how they learn from and apply voluntary regulation and schemes, rather than simply stating that they are subject to it.

- was not scored, as no charities mentioned a failure to comply with a voluntary regulation or scheme.

- 41% provided detailed information about how they monitored on ‘behalf of’ fundraising, including the methods they used, how they managed these fundraisers, and what training or support they provided.

- 48% gave a detailed overview of their complaints policies and processes, including how they responded to and resolved the complaints they had received, and what these complaints were about.

- 29% outlined in detail their policies for protecting vulnerable people and members of the public, including how they monitor this, how they mitigate risks, and what training they provide to staff.

Compliance of levy-refusing charities

Summary

We reviewed the reports of 41 levy-refusing charities. These charities scored comparatively lower than levy-paying charities for each of the reporting requirements.

Excluding those which did not use third party fundraising, many charities did not meet the reporting requirements, with a mere 13% (5 of 38 reports) reporting on all the requirements, and 32% (12 of 38) reporting on none of the requirements.

Levy-refusing charities reported on each of the six requirements a to f in the Act as follows:

- 66% included a statement about their fundraising approach (27 reports).

- 49% included a statement on the regulation or schemes they were bound by (20 reports).

- 5% mentioned a failure to adhere to a regulation or scheme (two reports).

- 21% included a statement on monitoring fundraising activities carried out by another person on behalf of the charity (eight of 38 reports; 41 reports were reviewed but three charities stated that all fundraising was carried out internally).

- 56% included a statement on the number of complaints about fundraising received in the last 12 months (23 reports).

- 22% included a statement on what the charity has done to protect vulnerable people and other members of the public whilst fundraising (nine reports).

Although most charities still included a statement setting out their fundraising approach (almost seven in 10) and the number of complaints they had received in the past year (almost six in 10), fewer than five in 10 stated whether they were subject to voluntary regulation.

Only two out of 41 charities mentioned a failure to comply with voluntary regulation, but we believe that all 41 charities should have included a statement to this effect. Charities with an annual fundraising expenditure of above £100,000 are eligible to make voluntary annual Fundraising Levy payments to the Fundraising Regulator. All of the 41 charities had fundraising expenditures above this threshold, but did not pay the levy for 2021/22. These charities were therefore not registered with the Fundraising Regulator and failed to comply with regulation.

Furthermore, just two in 10 charities included statements on how fundraising carried out on their behalf is monitored, and how they protect the public and vulnerable donors.

When levy-refusing charities reported on requirements, their reporting was typically clear; 54% of reports had all statements in the same section and we gave a positive score to between 56% and 96% of charities for all but one of the requirements. The exception was for statements on how fundraising carried out on the charities’ behalf was monitored, with only 38% of charities reporting on this in a clear way.

However, as with levy-paying charities, we found that the statements typically lacked detail, and we gave positive scores to just 13% to 50% of charities across all the requirements.

The lack of reporting by these charities may be partly explained by the fact that they are from organisations which are lower down the levy fee scale (see the methodology). These charities spend less on fundraising and typically also have a lower income. These charities may be less aware of the reporting requirements or may lack the resources that larger charities have for reporting. However, their scores were still considerably lower than the levy-paying charities sampled which were in the same levy fee bands.

Next steps

We have shared the findings and recommendations of this research with the Charity Commission for England and Wales and will work with them to promote good governance. We will also share the research with the Institute of Chartered Accountants in England and Wales (ICEAW), as some information may be relevant to charity auditors.

We have previously published guidance aimed at helping charities to comply with the Act but it is clear that some charities still have a number of areas for improvement. We have reviewed and updated this fundraising reporting requirements guidance.

Additionally, we will write to all the charities which, according to our analysis, did not report on any of the Act’s requirements and explain to them that we believe that they have failed to comply with the requirements of the Act. We will make it clear to these charities that they must improve the quality of their reporting and need to include these fundraising statements in all future annual reports.

Methodology

In July 2022, we reviewed a sample of annual reports filed with the Charity Commission for England and Wales.

- We reviewed each report looking for a fundraising statement which addressed the requirements of the Act.

- If these were not in one place, we searched through other relevant sections to ensure we did not miss key information.

- We scored each report for its compliance, based on the information supplied for each requirement (a to f) set out in the Act, with one meaning ‘present’ and zero meaning ‘not present’.

- To examine how well these statements were being communicated, we also separately scored on clarity and detail, and noted when the requirements were reported in one section.

One person analysed each report, to ensure greater consistency in scoring, and another person reviewed 10% of these scores to safeguard quality.

We reviewed the annual reports of 10% of all levy-paying charities for the levy year 2021/22 with a gross income of over £1 million, as only charities with a gross income of over £1 million have a legal duty to fulfil the reporting requirements of the Act. We excluded higher education institutes and arm’s length bodies.

To ensure we analysed the reports of a cross section of different sized charities in terms of their fundraising spend, we randomly selected 10% from each of the 12 levy fee bands (or a minimum of one from each band, whichever number was higher.)

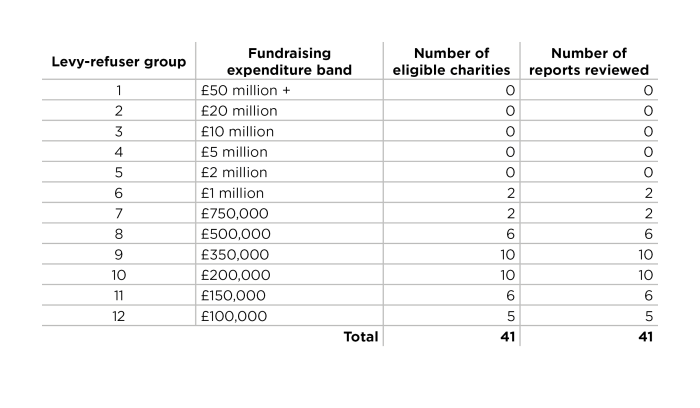

We also reviewed the reports of every charity with a gross income of over £1 million that either actively refused to pay the levy or did not respond to invoices to pay and follow-up reminders in 2021/22. We included these charities in this year’s sample because we wanted to assess whether there were any variations in levels of compliance between charities which pay and do not pay the levy.

This total sample size was 198 charities (157 levy-payers and 41 levy-refusers).

Levy-payers in 2021/22 with income of over £1 million

Levy-refusers in 2021/22 with income of over £1 million