Any organisation that carries out charitable fundraising in England, Wales or Northern Ireland can apply to register with the Fundraising Regulator.

Charity registration fees

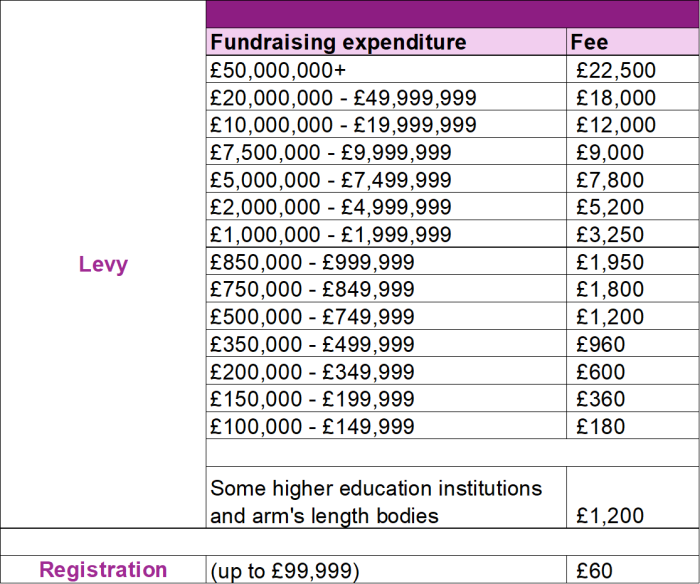

Charity registration fees are scaled on the basis of fundraising expenditure. If your charity spends over £100,000 on fundraising each year, we will invite your organisation to make a voluntary contribution to support the cost of fundraising regulation through the annual fundraising levy. Registration is also open to charities which spend less than £100,000 a year on their fundraising.

In September 2025 the levy and registration fees increased. You can find full details of the changes here.

Fee scale 2025

Charity registration fee scale table

Defining fundraising expenditure

Some charities may spend more or less on fundraising than the previous year. We conduct assessments of an organisation’s accounts as most recently filed with the Charity Commission in England and Wales or Northern Ireland. This means we can accurately calculate the amount they should pay in registration fees.

We define fundraising expenditure as the costs incurred by a charity when individuals or third parties make contributions to it for its charitable purposes, and any other costs related to charitable fundraising. This includes the costs of:

- staging events, including performance fees and licence fees

- seeking donations, grants and legacies

- operating membership schemes and social lotteries

- advertising, marketing and direct mail materials including publicity costs (not associated with educational material) designed wholly or mainly to further the charity’s purposes; and

- contracting agents to raise funds on behalf of a charity.

We also include:

- a relevant proportion of organisational overheads and support costs for governance, IT, finance, accommodation and HR

- the cost of all staff a charity employs to carry out fundraising activity - these staff can be engaged in public or private fundraising.

We exclude fundraising expenditure on trading activities, paying fees for investment advice or portfolio management.

Fundraising turnover

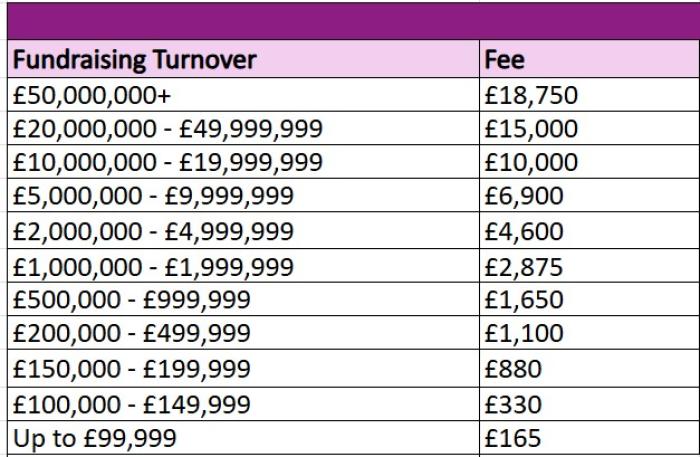

Non charities that carry out charitable fundraising are charged on the basis of fundraising turnover.

In January 2025, non-charity registration fees increased. You can find full details of the changes here.

2025 Fee scale

Non charity registration 2025 fee scale table

Defining fundraising turnover

We define fundraising turnover as the proportion of a company turnover that is generated from goods and services provided to its clients for the purpose of carrying out fundraising activities.

Getting in touch

If you have any questions about how your registration fee has been calculated, or wish to provide updated financial information, please email registration@fundraisingregulator.org.uk or call 0300 999 3407.