For the first time since it was founded, the Fundraising Regulator is to increase the yearly fee it asks non-charities (mainly commercial companies) to help pay to fund its work.

We appreciate that increased fees are unwelcome. We have already announced changes to the levy paid by charities, with increases being phased in over two years in September 2024 and September 2025. Non-charities benefit from our regulation in the same way that charities do, so we now set out plans for an increase in those fees consistent with those which have already been applied to charities. Subject to this review, we expect any revised fees to take effect in January 2025.

The increase will help us to continue providing proportionate self-regulation of the sector that promotes public trust in charitable fundraising.

The reasons for the changes are set out below and we invite you to share your views.

Background

In 2016, the Fundraising Regulator was set up to help make sure fundraising is legal, open, honest and respectful.

The creation of a new regulator was recommended by a cross-party review published in September 2015 in response to several high-profile cases where fundraising practices had caused significant public concern. The Government accepted all the recommendations of the review including the establishment of the Fundraising Regulator.

We have invited non-charity organisations to register with us since early 2017 as we recognise the value and role that they play in the fundraising sector.

We currently have approximately 170 non-charities registered, and they contribute about 6% of our income. Organisations engaged in newer forms of fundraising have registered, for example online fundraising platforms and some of those running free prize draws from which charities benefit.

We have not changed what we ask non-charity organisations to pay through registration since the scheme was launched in spring 2017.

Since the regulator was founded, we have worked to promote public trust in the sector by:

- Setting and promoting standards through the Code of Fundraising Practice and associated guidance.

- Investigating cases where fundraising practices have led to public concern.

- Adjudicating on complaints from the public about fundraising practice, where these cannot be resolved by the charities themselves.

- Operating the Fundraising Preference Service (FPS) to enable individuals to manage their contact with charities.

- Recommending best practice guidance and imposing proportionate sanctions where poor fundraising practice is judged to have taken place.

- Carrying out intelligence-led proactive projects to identify emerging or unaddressed issues about charitable fundraising and working with the sector to ensure a compliant level-playing-field. For example, our market inquiry about subcontracting in face-to-face fundraising.

Our research indicates that trust in this voluntary system of regulation continues to grow. Public awareness about the regulator is increasing and those that see the Fundraising Badge, the logo that says ‘registered with Fundraising Regulator’, are more confident about giving. Our research shows that the public would be more likely to think positively of charities that hold the Fundraising Badge.

You can find more detailed information on our history, work, governance and how we are funded here.

Reasons for registration

There are a number of benefits for non-charities engaged in fundraising activities to be registered with the Fundraising Regulator:

You visibly support the scheme of voluntary regulation

Being registered with the Fundraising Regulator shows donors and members of the public that you are committed to excellence in fundraising practice. Your name appears on the public Directory. A significant proportion of the public say the existence of the Fundraising Regulator makes them more likely to trust charitable fundraisers and donate.

You can use the Fundraising Badge (the badge)

There has been growing awareness of the badge amongst the public, charities and businesses since it was launched in 2016. Research conducted in 2022 showed that 61% of respondents would be more likely to think positively of a charity showing the Fundraising Badge.

If your company is a fundraiser, like an online platform or a community interest company (CIC), then the badge indicates that you aspire to best fundraising practice and that the public can trust you.

If your company supplies services to charities in the fundraising arena, then the badge may be a requirement of doing business and demonstrates to charities that you take your responsibilities seriously.

Why we need to increase our fees

Proactive regulation

In our Strategic Plan 2022-2027 we reaffirmed our commitment to being a proactive regulator. With this in mind, we are currently reviewing the Code of Fundraising Practice to take into account, among other things, the effect of digital currencies, blockchain, machine learning and artificial intelligence on the sector. In addition, we are making modest infrastructure improvements to ensure our business systems remain effective. We want to make sure we have adequate funding to continue to advise and support the sector during these changing times.

This year alone we have registered 38 non-charities. We are seeing a higher number of platforms and mobile technology organisations requesting to register with the Fundraising Regulator.

We have established a team to tackle regulatory issues as they arise and do more work to address prospective issues in the fundraising sector.

Economic climate

The economic situation continues to be challenging. Over the last few years our running costs have been affected by unexpected inflation of over 10%, even though this has recently fallen back to about 2%.

In addition, the decline in expenditure on fundraising by charities, particularly over the covid years, has had an effect on our income because for a while less was spent on fundraising.

For the current financial year, we have used funds from our reserves to support our budget in addition to the levy, registration, and non-charity fee income. We are likely to need to draw on our reserves again in our next financial year ending 31 August 2025. However, this is only sustainable for a maximum of two years before our reserves fall below a safe level of around six months of running costs. It is therefore not a long-term solution.

Caseload

As public awareness of the regulator has grown, so has our casework. Our caseload has increased by 26% over the previous two years, and includes investigations into fundraising agencies and CIC’s. In addition, as fundraising methods change and more fundraising happens online, our small team is dealing with an increasing number of complex cases. We want to make sure we have enough resources to support this work.

Alternative ways of meeting our costs

As part of our commitment to providing value for money, we have used different ways of supporting our work that didn’t involve increasing our fees.

These include:

Use of reserves

We currently keep a reserve fund of around £2m to support legal costs in case any of our decisions are challenged in court and to cover operating costs for six months should there be a significant interruption to our funding.

We are drawing on our reserves for the current financial year and the next one. However, as explained above, because of the need to keep our reserves at a safe level this is not a viable long-term solution.

Making savings

We believe we provide good value for money. Our options to reduce our running costs further through efficiency savings are very limited. We have a small team of around 30 people and believe this is an optimal size for the regulator.

Current funding model

We charge larger fundraising charities an annual levy according to the amount they spend on fundraising over £100,000. This equates to about 85% of our running costs. There are just over 2,000 charities paying the levy each year.

The remainder of our funding comes from small charity registrations (around 4000 charities paying a £50 fee, increasing to £60 from September 2024) and non-charity registrations (around 170 non-charity organisations paying a fee based on their annual turnover on fundraising activities) with a small amount raised from investment income.

Our funding system and rates have remained unchanged over the eight years since we were created.

We consulted charities in December 2023 regarding the proposed increase to their levy fees and the results of this consultation and our board’s conclusions can be found here.

Proposed funding model

We believe it is also fair that the non-charity fee is increased. These fees amount to around 6% of our revenue and amount to approximately £230,000. This review therefore sets out proposals for increasing these fees.

Proposals to increase fees:

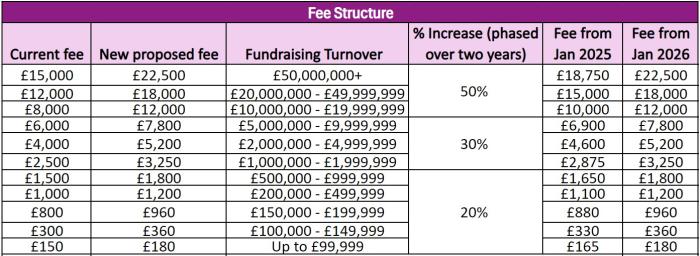

An increase of similar amounts to the levy, i.e. 20% – 50% phased over two years of the original 2023 fee, has been proposed in the same way as the proposals for larger charities who are required to pay the levy. Future rises will be more gradual, taking account of the prevailing rate of general inflation, the financial needs of the regulator, and the wider economic environment. We will let non-charity registration payers know what these will be in advance. An alternative would be to do this in one year, but we are conscious this may not provide the flexibility some organisations require in planning their budgets.

This mean that larger fundraising companies will bear a higher proportion of the increases.

Next steps

We are inviting feedback on the proposed increase for non-charities. Our board will then reflect on what you tell us and publish a summary and final decision. After that, the new registration fees will be confirmed, and it is the intention that they come into effect from 1 January 2025.

This review is now closed